Trailer depreciation calculator

Airstreams however will hold their value and. Section 179 deduction dollar limits.

Rv Depreciation Chart Year By Year Rv Value Loss

Of all the motorized campers the Class C vehicles depreciate the slowest.

. Just like with motorhomes there isnt much of a difference between a one year old Class C RV and a two year old Class C RV. Depreciation rate finder and calculator. Where Di is the depreciation in year i.

The MACRS Depreciation Calculator uses the following basic formula. C is the original purchase price or basis of an asset. The calculator should be used as a general guide only.

For instance if you paid 20000 for the mobile home your initial depreciation. D i C R i. For example if you have an asset.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Gas and oil mining support services excluding offshore services. The extent that travel trailer and RV values depreciate does vary based on how many miles the RV has been driven how well its systems and interior have been taken care of.

When you purchase a camper of any sort you can bet that theres going to be depreciation for the first few years right after you have purchased it. Two years after purchase 5th wheel trailers depreciate on average 57 per year. With a length of 33 feet a Class C RV is the sweet spot between a camper van and tour bus.

Other mining support services. This limit is reduced by the amount by which the cost of. Percentage Declining Balance Depreciation Calculator.

Calculate depreciation for a business asset using either the diminishing value. After five years of life. 133 rows 1 Jul 2021.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. 5th wheel trailer depreciates 193 in the first year of purchase which is quite a lot. You can use this tool to.

There are many variables which can affect an items life expectancy that should be taken into consideration. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Reduce the sale price of the mobile home to 80 percent if it is furnished and 95 percent if it is unfurnished.

Find the depreciation rate for a business asset.

Daily Load Planning Under Different Autonomous Truck Deployment Scenarios Sciencedirect

Sustainability Free Full Text Transport Airships For Scheduled Supply And Emergency Response In The Arctic Html

Triple Wide Mobile Homes Floor Plans Find House Plans Mobile Home Exteriors Triple Wide Mobile Homes Mobile Home Floor Plans

Cool Gadgets World Car Accessories For Girls Cars Organization Car Storage

Rv Depreciation Chart Year By Year Rv Value Loss

2022 Jeep Wrangler Lease In Windsor On Provincial Chrysler Dodge Jeep Ram

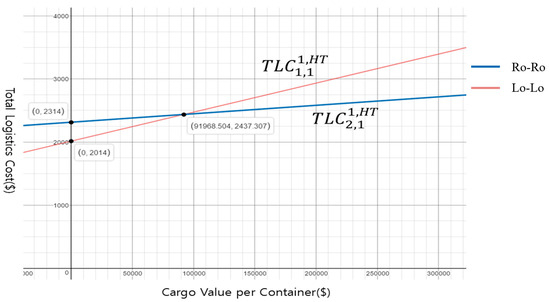

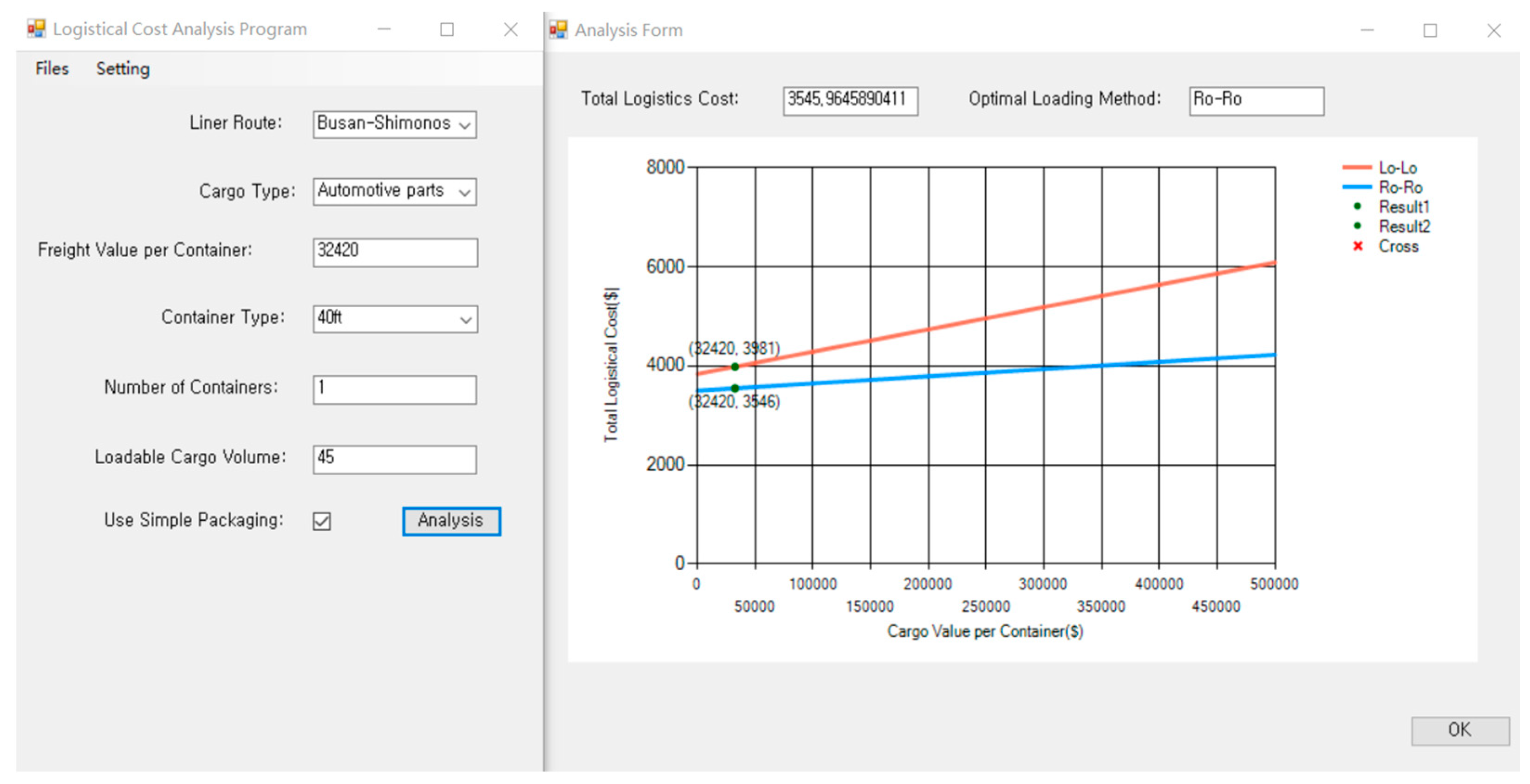

Jmse Free Full Text Cost Effectiveness Analysis In Short Sea Shipping Evidence From Northeast Asian Routes Html

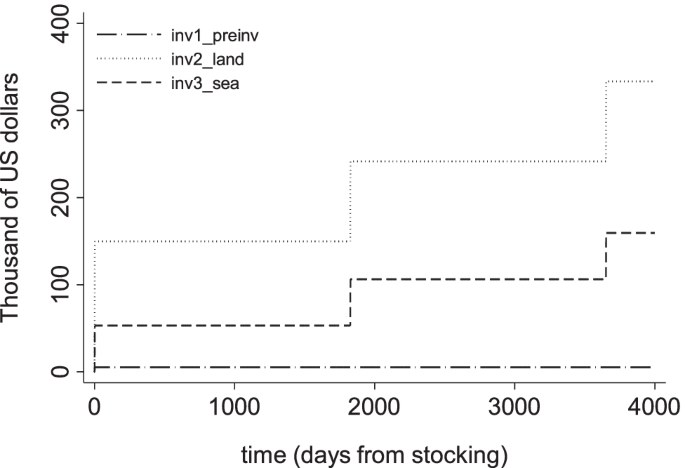

Economic Valuation Of The Commercial Aquaculture Of Sarcopeltis Skottsbergii In Southern Chile Springerlink

Pin On Chart

Jmse Free Full Text Cost Effectiveness Analysis In Short Sea Shipping Evidence From Northeast Asian Routes Html

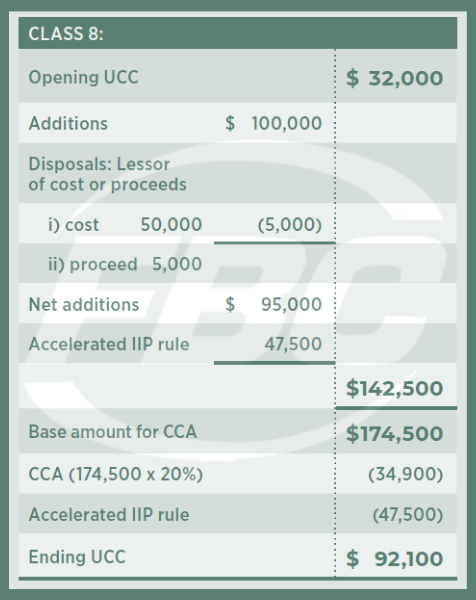

Capital Cost Allowance For Farmers Fbc

Rv Depreciation Chart Year By Year Rv Value Loss

Calculate Beam Loading Like For A Trailer Frame Mechanical Elements In 2022 Custom Trailers Trailer Plans Best Trailers

Plant Flower Blossom And Geranium Hd Photo By Anastasia Lysiak Nesslovetim On Unsplash Photo Lily Evans Geraniums

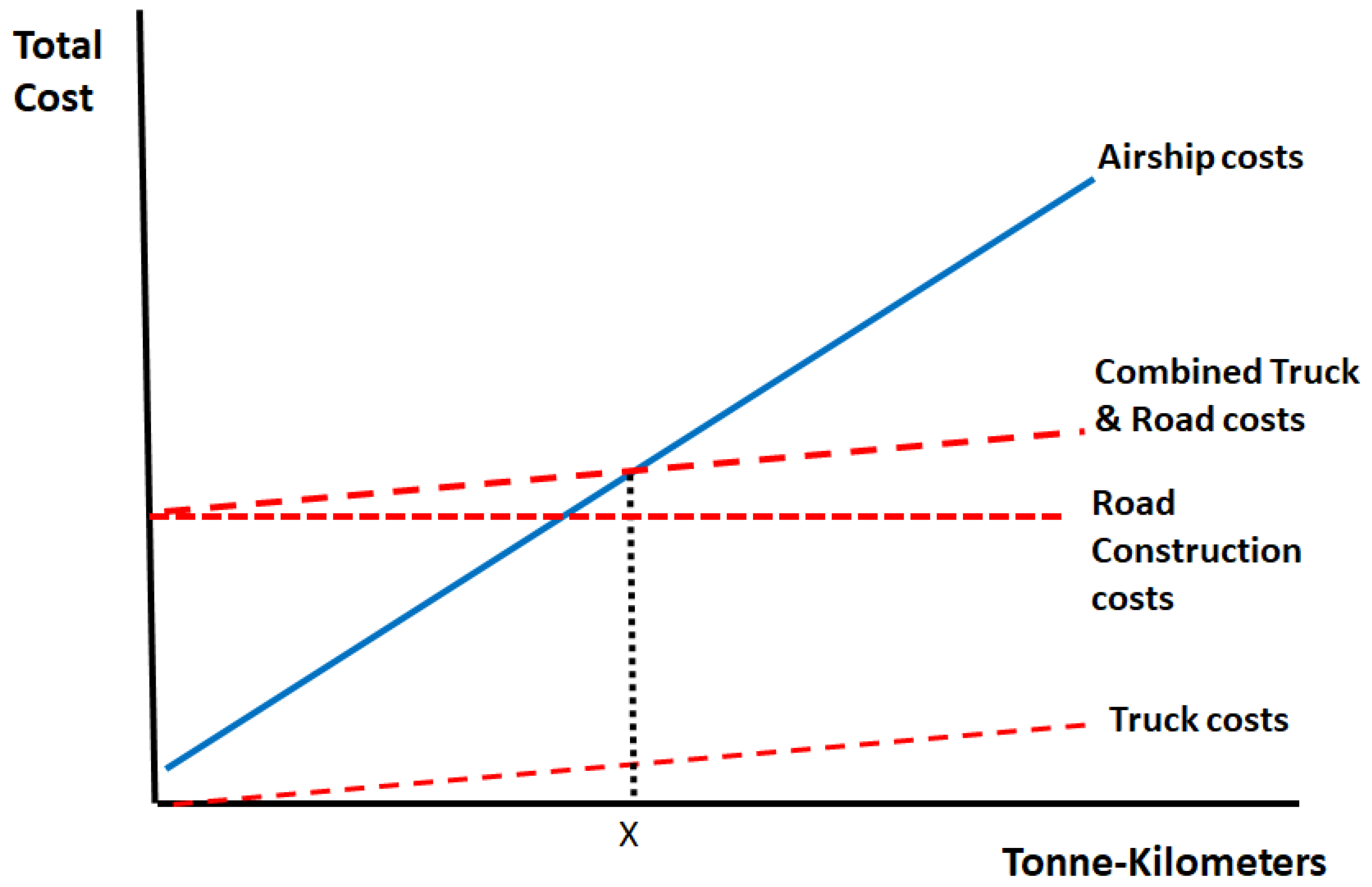

3 3 Transport Costs The Geography Of Transport Systems

How To Work Out The Value Of Your Car Car Family Car Workout

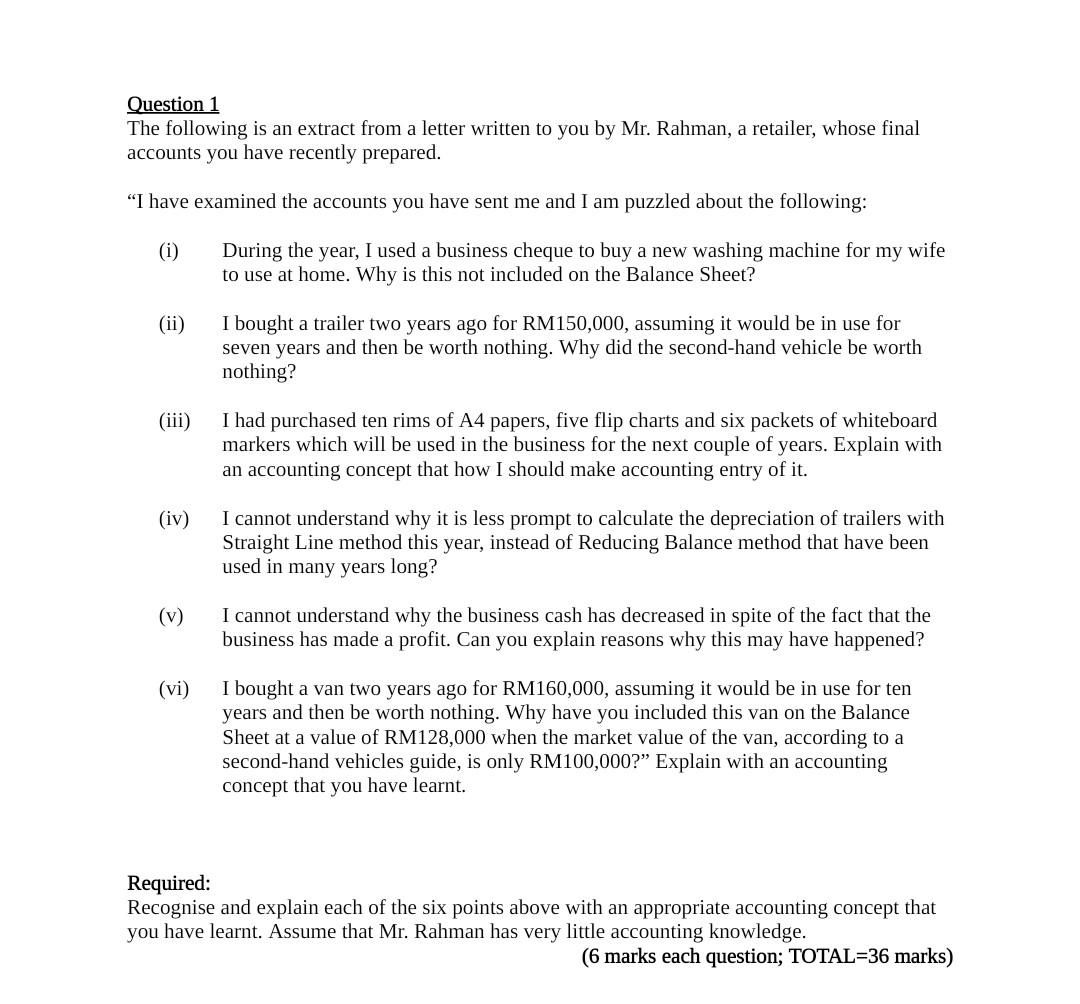

Solved Question 1 The Following Is An Extract From A Letter Chegg Com